Tax Assessor

Lavallette Municipal Building

1306 Grand Central Avenue

Lavallette, NJ 08735

Sharon Morgan, Tax Assessor

Contact the Assessor

Office Hours: Wednesday 3:30pm to 5:30pm

732-793-7477

x612 Phone

Extension must

be used as there is no option for the assessor on the phone

system.

Fax 732-830-8248

Mailing Address:

Lavallette Tax Assessor

1306 Grand Central Avenue

Lavallette, NJ 08735

2026

Tax Proof Book

2026

Tax Proof Book

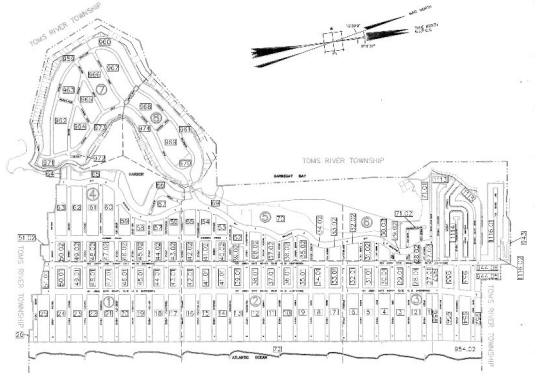

Tax Maps

Tax Maps

Tax Maps

Maps are in pdf format

Maps may take some time to load, if maps don't load right click

on the link and click save link as or save target as to download pdf file.

Tax

Rates & Ratios

Tax

Rates & Ratios

| Rate | Ratio |

| 2025 | |

| 1.014 Per $100 | 61.10% |

| 2024 | |

| .946 Per $100 | 68.41% |

| 2023 | |

| .918 Per $100 | 75.84% |

| 2022 | |

| .854 Per $100 | 88.93% |

| 2021 | |

| .826 Per $100 | 98.54% |

| 2020 *Revaluation | |

| .821 Per $100 | 100% |

| 2019 | |

| .979 per $100 | 83.04% |

| 2018 | |

| .971 per $100 | 88.53% |

| 2017 | |

| .981 per $100 | 86.70% |

| 2016 | |

| .949 Per $100 | 90.74% |

| 2015 | |

| .929 Per $100 | 92.26% |

| 2014 | |

| .933 Per $100 | 88.86% |

| 2013 | |

| .921 Per $100 | 86.47% |

| 2012 | |

| .902 Per $100 | 82.76% |

| 2011 | |

| .886 Per $100 | 81.07% |

| 2010 | |

| .882 Per $100 | 77.25% |

| 2009 | |

| .850 Per $100 | 75.17% |

| 2008 | |

| .843 Per 100 | 75.20% |

| 2007 | |

| .797 Per 100 | 80.48% |

Added Assessments and Omitted Added Assessments

Added Assessments and Omitted Added Assessments

New construction, structural additions and

improvements completed after October 1 are valued and taxed

under the Added Assessment Law. This includes properties

that had a reduction in value due to the storm and have

now made repairs. This way property which becomes assessable

after October 1 does not avoid its fair share of the tax

burden for the rest of the year. A new structure, or an

addition to or alteration of an old structure, completed

after January 1 and before October 1, is valued as of the

first day of the month following completion. If the value

when completed is greater than the assessed value placed

on the structure on October 1 of the pretax year (partial

assessment based on the value present at that time), an

added assessment based on the difference must be made. The

added assessment is prorated on the number of full months

remaining in the tax year. Tax exempt properties which lose

their exempt status are also subject to the Added Assessment

Law. Added Assessments are payable on November 1 and become

delinquent if not timely paid.

Additional assessments

that, through error, were not made at the proper time, may

be placed on the tax rolls through the Omitted Assessment

Laws. An Omitted Assessment can be made for the current

year and one prior year.

The Added Assessment bill will be mailed to your mortgage holder, if you have one, and you will receive an advice only copy.

Please note, not scheduling a final inspection

for your building permit does not delay the added assessment

tax bill. As noted above, the final inspection does not

trigger the assessment.

Not getting a permit does

not prevent an assessment. An assessment of an improvement

is made regardless of whether there was a permit or not.

Whether you agree or do not agree with the assessment,

you must pay the bill for the added assessment. By December

1st you may appeal the added assessment. No one can appeal

the added assessment after 1 December, not even the Assessor.

If the taxes are not paid, the appeal will not be heard.

Tax Deductions

Tax Deductions

Tax Forms For Qualifying Property

Owners

Initial Statement for Tax Exempt properties![]()

Further Statement for Tax Exempt properties![]()

Homestead

Rebate

Administered by the NJ Division

of Taxation through NJ income tax returns (Form HR-1040

and NJ-1040 if required). For more information, visit the

link below.

NJ Division of Taxation Homestead Rebate

Property

Tax Reimbursement

Administered by the

NJ Division of Taxation. For more information and filing

date visit the link below.

NJ Division of Taxation Reimbursement

Senior

Citizen or Surviving Spouse of a Senior Citizen or Disabled

Annual Property Tax Deduction

An annual

deduction for those 65 or older or permanently and totally

disabled or qualifies as a surviving spouse of a senior

citizen or disabled person with incomes less than $10,000

per year, excluding Social Security payments and other permitted

exclusions. Applicants must own and reside in the home on

which the deduction is claimed. The application forms are

available in the Tax Assessor’s office or from the

State website.

Senior Citizen/Disabled Application (must accompany the

supplemental income form)![]()

Senior Citizen/Disabled Application Supplemental Income

Form![]()

Veteran’s

Deduction

An annual deduction from property

taxes is available to qualified veterans or un-remarried

widows of veterans. Claimant must be a New Jersey citizen

prior to October 1st of pretax year. The application forms

are available in the Tax Assessor’s office. Veterans, who

were honorably discharged and actively served during the

following wars may be eligible and can apply for a deduction:

Joint Guard Mission-Bosnia and Herzegovina, Joint Endeavor

Mission-Bosnia and Herzegovina, Restore Hope Mission-Somalia,

Operation “Desert Shield/Desert Storm”, Panama Peacekeeping

Mission, Lebanon Peacekeeping Mission, Grenada Peacekeeping

Mission, Vietnam Conflict, Korean Conflict, Word War I and World

War II. Dates of induction/service apply. For dates for

these military actions visit the link below

NJ Division of Taxation Veteran’s Deduction

Veteran Application (must be accompanied with the supplemental

form)![]()

Exempt Disabled Veteran Application / For 100% Disabled

Veteran![]()

Sample Letter For 100% Disabled

Veteran

Important Assessment Dates

Important Assessment Dates

January - Tax Books are filed with the County

![]() Demolished structures

Demolished structures

![]() New exemptions

New exemptions

![]() Tax map

Tax map

![]() Estimate amounts of veterans approved

Estimate amounts of veterans approved

![]() Estimate amount of senior citizens approved

Estimate amount of senior citizens approved

![]() New construction

for Budget Cap purposes

New construction

for Budget Cap purposes

February 1 Notify each taxpayer,

by post card, of the current assessment and the previous

year’s taxes; include tax appeal information

March

1 Hearings on County Equalization tables

April 1

Deadline for tax appeals

May 20 County Board to certify

general tax rates

July 1 Process Building Permits,

new property record cards, added assessments

August

1 Deadline for farmland assessment

Defend Tax Appeals

September Complete all added assessment records

October 1 Assessing date for all real property in

the District

All required conditions for Veterans Exemption

must exist by October 1

File added Assessment List

All Exemptions must be filed with the exceptions of seniors

which is due by December 31

December 1 Added assessment

appeal deadline

Defend added assessments

Proof tax

list

Advertise that the Tax is open for inspection

Tax Appeals

Tax Appeals

Reason

for an Appeal

An unfair assessment that

is unreasonable compared to the market value. It is important

to understand, you cannot appeal the taxes on a property,

since taxes are the result of the budget process.

When to

File an Appeal

Taxpayer must prove an

assessment is unreasonable, compared to a market value standard.

Your current assessment is assumed by law to be correct.

You must overcome this presumption of correctness to gain

an assessment reduction.

Taxpayers are required to present their opinion of true market value as of October 1st of the pre tax year. An average ratio is developed annually through the property transfers which represents the assessment level in that district. The common level of assessment is the average ratio of the district. In 1973, New Jersey Legislature adopted a formula known as Chapter 123 to test the fairness of an assessment. If the ratio of the assessment to true value exceeds the average ratio by 15%, then the assessment is automatically reduced to the common level. However, if the assessment falls within a common level range + or – 15%, of the average ratio, no adjustment will be made. If the assessment to true value ratio falls below the common level range, the Tax Board May Increase the Assessment to the Common Level.

The taxpayer must supply sufficient evidence to enable the Tax Board to determine the true market value.

The deadline for filing an appeal is April 1st, December 1st for added and omitted assessments and May 1st for revaluations or reassessments. You must provide credible evidence. Also, you must pay the collector all taxes in order to be granted a hearing.

To file an Appeal, Contact:

The Ocean County Board

of Taxation

Ocean County Court House, Room #215

118

Washington Street, P.O. Box 2191

Toms River, New Jersey

08754-2191

Website: tax.co.ocean.nj.us

Phone: 732-929-2008